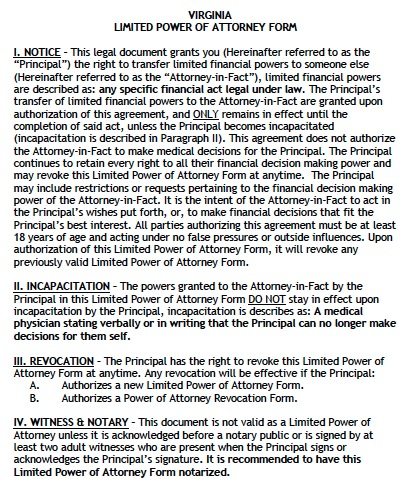

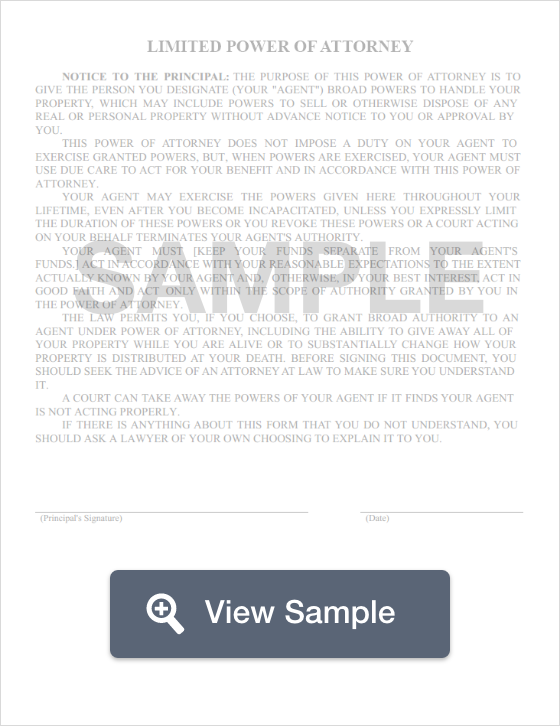

Virginia limited power of attorney form is the paperwork required for an agent to prove he or she has your approval to represent you in a specific matter or distinct transaction s.

Virginia limited power of attorney.

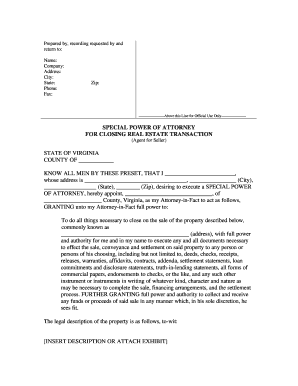

Federal form 2848 virginia tax matters form number and tax periods must be specified.

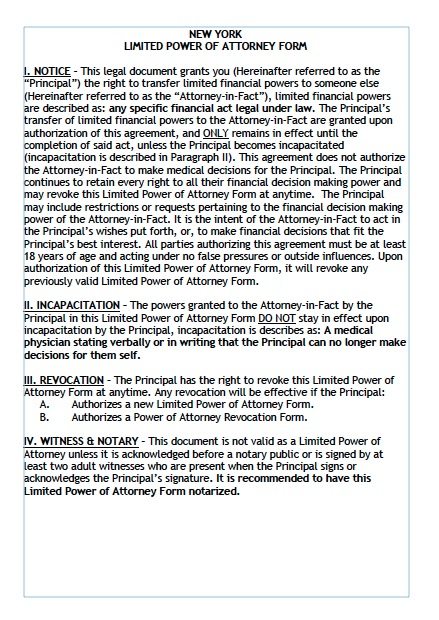

The form can be made to grant restricted access to one s personal affairs such as collecting mail handling a real estate transaction or paying bills on the principal s behalf.

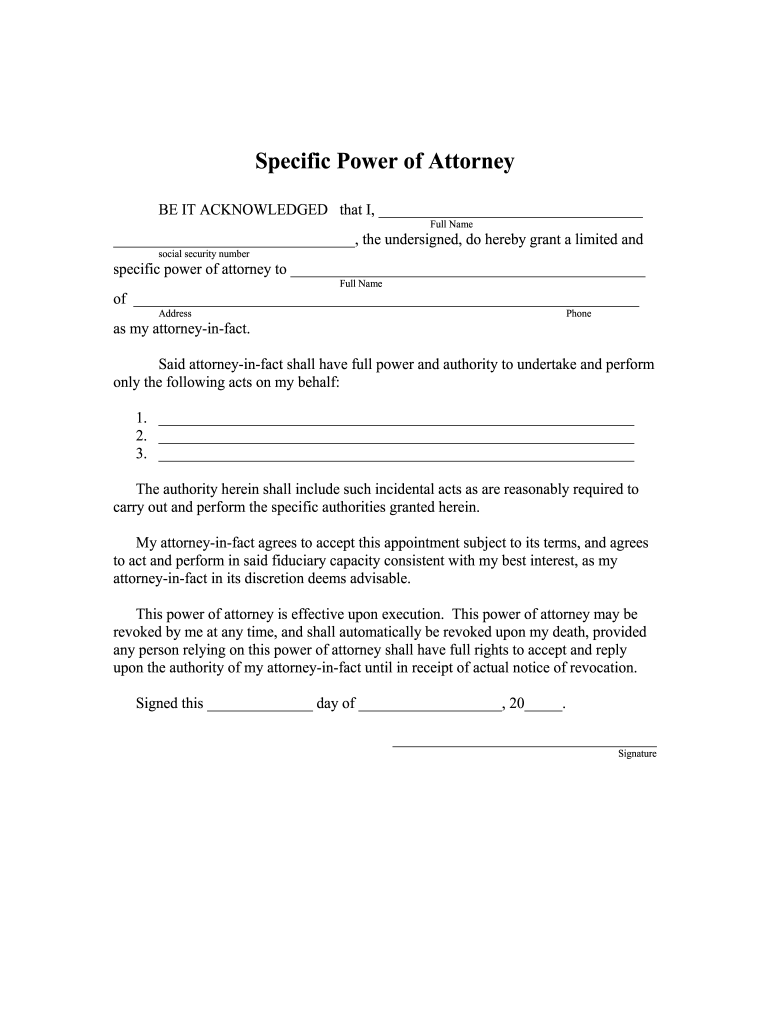

If a principal want the attorney s in fact to receive reasonable compensation for their service they must make note of it in the poa document.

The virginia limited power of attorney form is used to select an agent to handle certain financial actions or decisions as described by the principal.

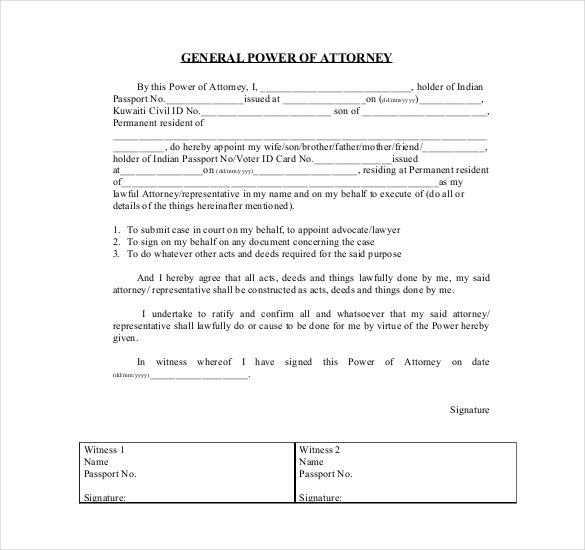

Power of attorney poa your written authority for an individual to act on your behalf in specific matters.

455 632 26 79.

When power of attorney effective.

The form is not durable meaning if the principal should become mentally incapable of making decisions on their own the form terminates.

The virginia limited power of attorney form is used to select an agent to handle certain financial actions or decisions as described by the principal.

The form can be made to grant restricted access to one s personal affairs such as collecting mail handling a real estate transaction or paying bills on the principal s behalf.

There are numerous scenarios where the presence of you or a representative is mandatory.

Poa forms durable general limited specific etc the poa must include state tax matters.